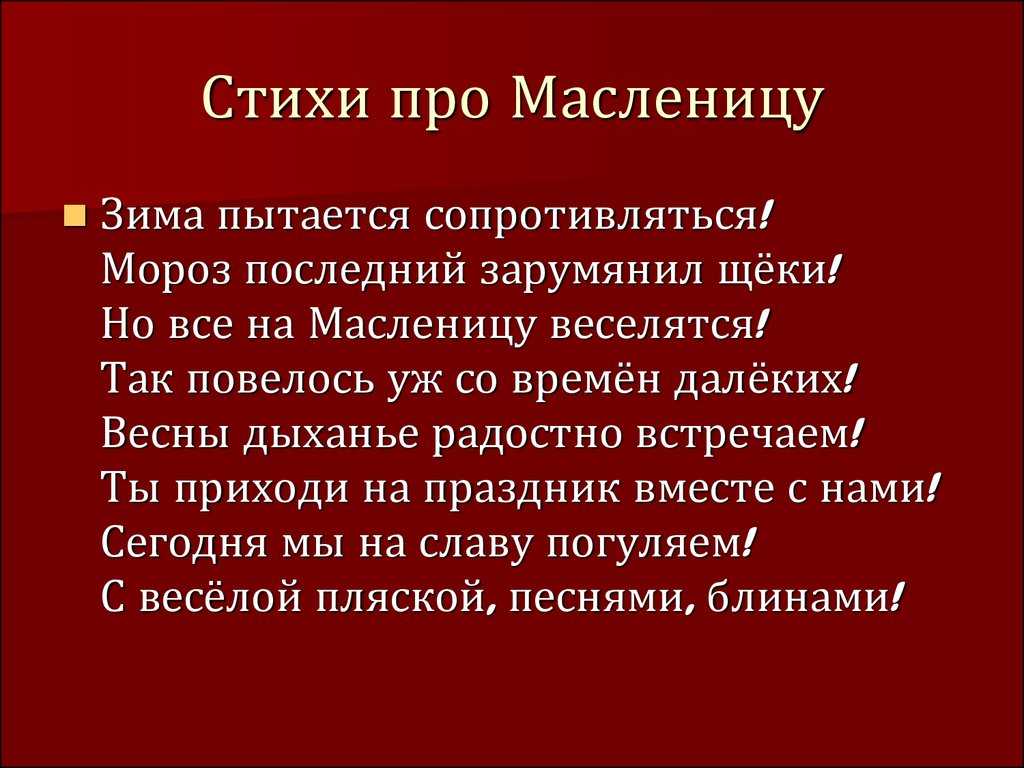

Масленица - это главный праздник весны. В честь него многие школы и сады проводят

Веселые частушки для детей. Частушки для детей дошкольного и школьного возраста. Частушки про природу,

Частушки к дню учителя - МБОУ `Каратузская СОШ` имени Героя Советского Cоюза Е.Ф.Трофимова

Частушки – это короткие песенки часто с юмористическим содержанием. Они издавна сопровождают народные торжества.

Частушки про космос и космонавтов для школьников | Анекдоты, цитаты, статусы, загадки, стихи, фразы

В сценарий 8 марта воспитатели обязательно включают задорные детские частушки, используя музыкальное сопровождение. Вот

Какие смешные частушки подойдут для празднования Нового 2022-2023 года. Веселые четверостишия для детей, школьников,

Детские поздравительные частушки на день рождения способны удивить и обрадовать всех без исключения.

Стихи про дедушку для детей. Подборка стихов к 23 февраля. У нас был лучший

В подборку включены стихи о пожилых людях, о бабушках и дедушках, прабабушках и прадедушках.

Подборка забавных частушек и смешных музыкальных поздравлений к 8 марта

По традиции школьные выпускники поют песни, читают веселые частушки. А мы сделали для вас

Стихи для выпускного, прощание с детским садом и воспитателями. Дети уходят в школу.

Конечно, кроме разучивания слов, стоит показать крохам (можно на своем примере), что в этих

Сайт "Мама может все!" собрал частушки про выпускной в школе. Давайте, весёлыми куплетами проиллюстрируем

Признаки качественных прилагательных? Какие бывают? Наглядные примеры и правила. Степени прилагательных. Расскажем просто о

Что такое воинский учет и кто является военнообязанным в России. Обязанности в запасе. Когда

Это интересная и мудрая притча о прорабе и его последнем построенном доме. Это история

В Евангелиях рассказано, как Сын Божий разговаривал с людьми с помощью иносказаний, удобных для

Короткие притчи, в которых собрана мудрость разных поколений, не оставят вас равнодушными. Читайте и

Библейские притчи для учащихся 4-5 класса Притча о злых виноградарях В Иерусалиме Христос каждый

Наступит время, когда любой матери нужно будет задуматься об этом. Мудрая притча о женщине,

Красивые и мудрые притчи о любви, которые подскажу, что нужно ценить в отношениях и